BOI Investment Incentives

GDC Golden Circle Firm Co., Ltd.— Professional and trustworthy

In order to obtain investment promotion, the BOI applicant must follow the conditions prescribed by the Board of Investment as specified in the BOI promotion certificate in which the following incentives will be granted:

Basic Incentives

Tax Incentives

Exemption/reduction of import duties on machinery

• Exemption of import duties on materials imported for R&D purposes

Non-tax Incentives

• Permit to bring into the Kingdom skilled workers and experts to work in investment promoted activities

• Permit to own land

• Permit to take out or remit money abroad in foreign currency

Additional Incentives

Competitiveness Enhancing Incentive

• Research and Development (R&D)

• Licensing fees for using domestically developed technology

• Product and package design

• Support for S&T organizations such as academic institutions, specialized training centers, research institutes, and public agencies, including various funding such as technology and innovation, personnel development as approved by the BOI

• Advanced technology training

• Organizing training or accepting student internships for work training and skill development during their science and technology education

• Local supplier development

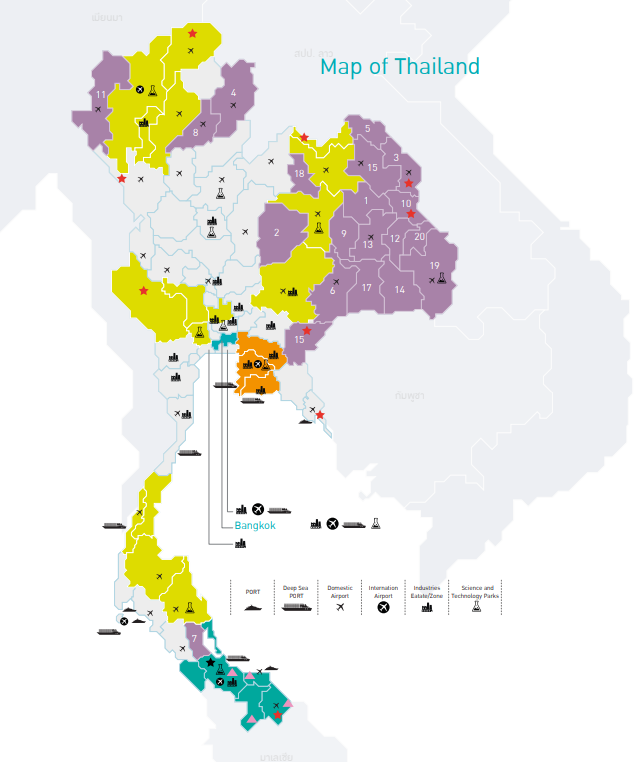

Area-based Incentives

• BOI-promoted industrial estates or zones

• Science and Technology Parks (TSP, Food Innopolis, Space Krenovation park)

• The Eastern Special Development Zone (Eastern Economic Corridor : EEC)

• Special Economic Zones in 4 Regions (NEC, NeEC, CWEC, SEC)

• Special Economic Zones (SEZ)

• Southern Border Area

20 provinces with lowest income

20 provinces with lowest incomev : Kalasin, Chaiyaphum, Nakhon Phanom, Nan, Bueng Kan, Buri Ram, Phatthalung, Phrae, Maha Sarakham, Mukdahan, Mae Hong Son, Yasothon, Roi Et, Si Sa Ket, Sakhon Nakhon, Sa Kaeo, Surin, Nong Bua Lamphu, Ubon Ratchatani and Amnatcharoen

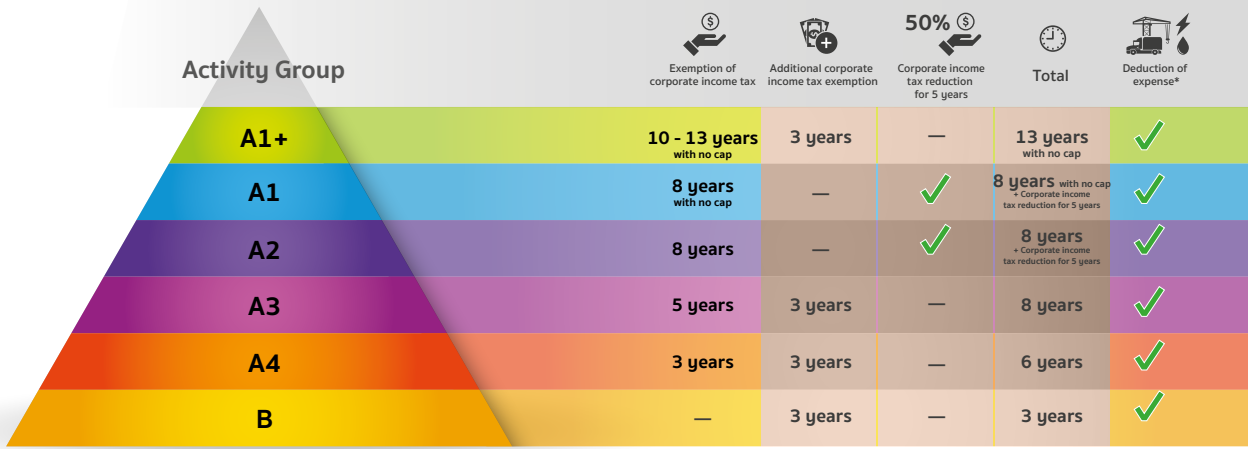

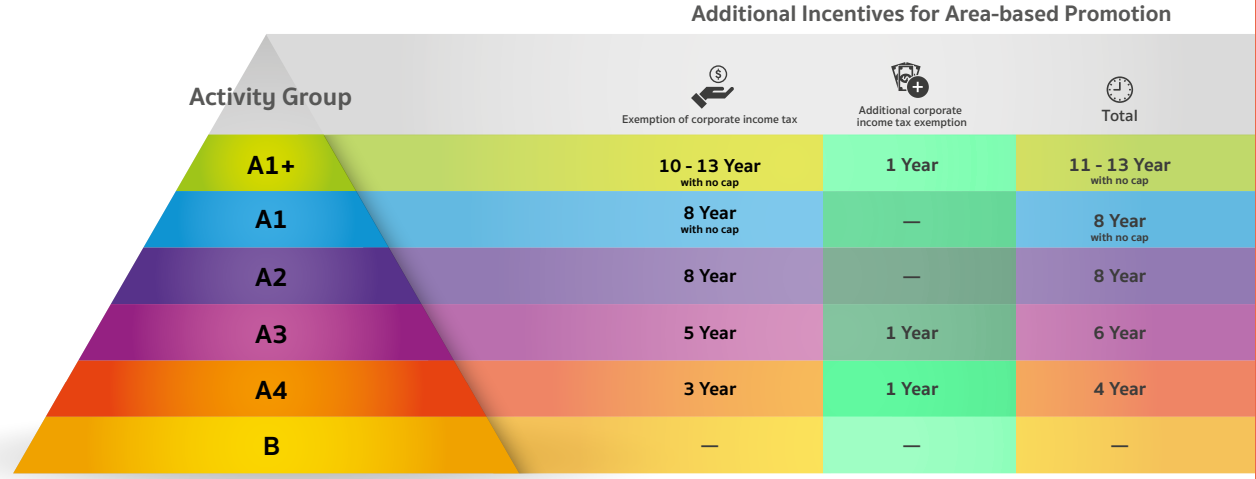

Projects located in 20 Areas with low per capital incomes shall receive Three additional years of corporate income tax exemption shall be granted. Projects with activities in Group A1 or A2 shall instead receive a 50% reduction of corporate income tax on net profit derived from promoted activity for 5 years after the corporate income tax exemption period expires.

Promoted Industrial Estate / Zone

Promoted Industrial Estate / Zone Projects located within industrial estates or promoted industrial zones shall be granted one additional year of corporate income tax exemption.

Agenda - based Incentives

• Social and Local Development Investment Programs

GDC Firm

With GDC Firm, you're not just getting a service provider; you're gaining a dedicated partner committed to your financial success. Our team of experienced professionals is here to simplify your financial management, minimize risks, and maximize opportunities. Ready to take control of your finances and make informed decisions? Contact us today, and let's embark on a journey to financial empowerment together. With GDC Firm, your financial success is our top priority.